Political Risk Insurance

With 40+ years of experience, crediteureka is an experienced agency for companies, banks, and investors interested in political risk insurance. We’ve helped companies holding government contracts in diverse places – from Algeria to Zimbabwe – and in various industries. Some examples include global fiber optic cables, consumer product sales to the Middle East, gas pipelines across Eastern Europe, and aviation fees supporting securitized debt.

What Is Political Risk Insurance?

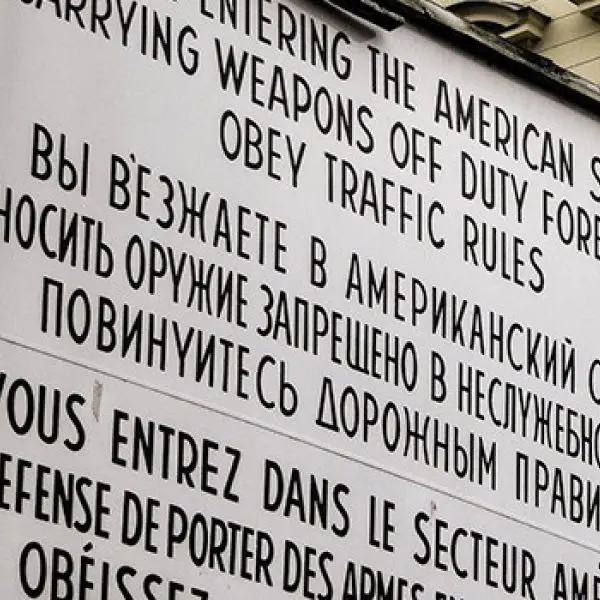

Political risk insurance (PRI), or cross-border insurance, is essential for safeguarding international investments and operations from losses caused by local political instability or government actions. PRI protects a company‘s physical assets, investments, projected earnings, and contractual commitments in foreign countries from losses caused by local government default, seizure, regulatory impairment, trade embargo, a civil strike, riot, or other form of political violence. Insurers offer coverage in over 150 countries around the world and for up to 15 years duration. Recent examples where insurers have paid claims include losses on operations in Ukraine, nationalization of oil facilities in Latin America, and damages sustained in Egypt during the Arab Spring.

Who Buys Political Risk Insurance?

Multinationals with large capital outlay, and long-term equity investments overseas. Manufacturers, Commodity, Infrastructure Sponsors, EPCs, Banks, Telecommunication, Technology, Telecommunication, Aviation, and other Transportation-related companies

- Companies that are awarded large contracts with foreign governments

- Companies with equity investments overseas

- Companies with overseas operations in special economic zones

- Companies who want to lower the cost of capital for investments in property, a plant, a fab, inventory, or equipment in a foreign country

- Companies with fleets of mobile assets in & out of foreign countries, such as shipping, aviation, mining, and energy companies.

- Banks extending credit to foreign government-owned banks

- Investment banks enhance the rating (lower the cost of capital) on securities backed by foreign cashflows or security located in foreign country

- Companies & banks with large amounts of capital on deposit in a foreign country

How Much Does Political Risk Insurance Cost?

- Contact Us for Insurer Rates. Premiums typically are a factor of:

- A per annum rate X $ amount of insurance a company requests.

What Risks Are Covered? Primary Examples Are:

- Nonpayment by foreign governments

- Inconvertibility of local currency into USD, EUR, or Yen for repayments, dividends, or other cash outflows to a parent company, subsidiaries, or suppliers located outside the host country

- Seizure or confiscation of company’s property or capital by host government

- Destruction/losses due to political violence or civil commotion

- Failure by a local government entity to honor guarantees

- False calling of your company’s posted security by a local government entity

- Calling of bonds or guarantees due to strikes, riots, war, or insurrection in host country

How Long Does It Take To Put A Program In Place?

From insurer receipt of completed application/insurance request:

- 2 weeks for a single project/transaction in a single country

- 2 – 4 weeks for risks involving multiple countries.